Star Health Insurance: A Complete Guide to India’s Trusted Health Partner

When it comes to health insurance in India, Star Health and Allied Insurance Company stands out as one of the most trusted names. Established in 2006, it has earned a solid reputation for its customer-first approach, quick claim settlement, and a wide range of plans designed to meet the healthcare needs of individuals and families.

But what makes Star Health truly special isn’t just the policies — it’s the way the company handles emergencies, supports customers through tough times, and constantly evolves with India’s changing healthcare landscape.

Let’s dive deep into everything you need to know about Star Health Insurance — from its key features and benefits to real-world stories, expert tips, and lessons learned from users’ experiences.

1. Introduction to Star Health and Allied Insurance

Founded in 2006 and headquartered in Chennai, Star Health Insurance was India’s first standalone health insurance company. Unlike traditional insurers that also deal with car, home, or travel policies, Star Health focuses purely on health insurance, which gives it a sharper understanding of medical expenses, treatment patterns, and customer needs.

Over the years, it has built a strong presence with:

900+ branch offices across India

14,000+ employees and agents

Over 13,000 network hospitals for cashless treatment

A claim settlement ratio consistently above 90%

In 2021, Star Health went public, becoming India’s first listed standalone health insurance company. That move increased transparency and customer trust even more.

| No. | Plan Name | Coverage Amount (Sum Insured) |

| 1 | Star comprehensive insurance policy | ₹5 lakh – ₹1 crore |

| 2 | Star family health optima | ₹3 lakh – ₹25 lakh |

| 3 | Star women care insurance policy | ₹5 lakh – ₹1 crore |

| 4 | Star senior citizens red carpet policy | ₹1 lakh – ₹25 lakh |

| 5 | Star micro rural and farmers care | ₹1 lakh – ₹5 lakh |

2. Why Star Health Insurance is Different

There are many insurance companies in India, but Star Health stands out because of its simplicity, accessibility, and care-driven service.

Key Differentiators:

1. No Third-Party Administrators (TPAs):

Star Health handles all claims in-house. This reduces delays, improves customer communication, and ensures faster settlements.

2. Wide Range of Plans:

Whether you’re a young individual, a senior citizen, or a family with kids, there’s a Star Health plan tailored for you.

3. Cashless Treatment Network:

More than 13,000 hospitals across India are tied up with Star Health for cashless treatments.

4. Digital Support:

With their mobile app and website, you can buy, renew, or claim policies online easily.

5. Transparent Claim Process:

Their track record of quick, fair claim settlements gives them a loyal customer base.

3. Popular Plans by Star Health Insurance

Star Health offers multiple plans for different age groups and medical needs. Below are some of their most popular and practical ones.

3.1 Star Comprehensive Health Insurance Policy

A flagship plan designed for families and individuals.

Key Highlights:

Covers hospitalization, maternity, and newborn expenses

Provides air ambulance cover

Health check-up benefits every claim-free year

Coverage up to ₹1 crore

3.2 Family Health Optima Insurance Plan

Perfect for families with 3–6 members under one umbrella policy.

Highlights:

Auto recharge of sum insured if exhausted

Newborn baby cover from the 16th day

Emergency domestic medical evacuation

Affordable premium options

3.3 Senior Citizens Red Carpet Policy

Specially crafted for people above 60 years.

Highlights:

No pre-insurance medical screening required

Covers pre-existing diseases from the 2nd year

Lifelong renewability

Coverage up to ₹25 lakhs

3.4 Star Health Gain Insurance Policy

Ideal for people seeking affordable health protection.

Highlights:

Covers outpatient consultations and pharmacy bills

Policy available for individuals or families

Great for first-time health insurance buyers

3.5 Star Cancer Care Gold Policy

Exclusive for those diagnosed with cancer.

Highlights:

Covers both treatment and follow-up care

Provides coverage for hospitalization and chemotherapy

Can be availed by people already diagnosed with cancer

4. Real-World Example: How Star Health Made a Difference

In 2022, a Mumbai-based family faced an emergency when their 9-year-old daughter was hospitalized due to dengue. Their hospital bill crossed ₹1.8 lakh.

Since they were covered under Star Family Health Optima Plan, they received cashless approval within two hours.

The family didn’t have to pay a single rupee during discharge. The claim was settled directly between the hospital and Star Health.

This case reflects the company’s commitment to real-time support — a critical factor when dealing with stressful medical situations.

5. Coverage Details: What Star Health Policies Include

Most Star Health policies include a comprehensive range of coverages that ensure peace of mind.

5.1 Inpatient Hospitalization

Covers expenses for room rent, nursing, medicines, ICU charges, doctor fees, and surgery costs.

5.2 Pre and Post Hospitalization

Expenses incurred before and after hospitalization (30–60 days pre and up to 90 days post) are covered.

5.3 Day-Care Treatments

Covers treatments that don’t require 24-hour hospitalization — like cataract surgery, dialysis, and chemotherapy.

5.4 Ambulance and Air Ambulance

Most plans cover road and air ambulance charges during medical emergencies.

5.5 Maternity and Newborn Cover

Plans like Star Comprehensive provide coverage for maternity expenses and newborn care.

5.6 Health Checkups

Annual health check-ups help policyholders monitor their health and detect issues early.

5.7 Pre-Existing Diseases

Pre-existing conditions are covered after a waiting period of 12–48 months, depending on the plan.

6. Exclusions: What Star Health Doesn’t Cover

Like any insurer, Star Health has some exclusions:

Cosmetic or plastic surgeries (unless medically necessary)

Injuries from self-harm or substance abuse

Treatments during war or nuclear activity

Dental and vision (unless caused by accident)

Pre-existing conditions during waiting period

Understanding exclusions is vital before purchasing a policy to avoid future disappointments.

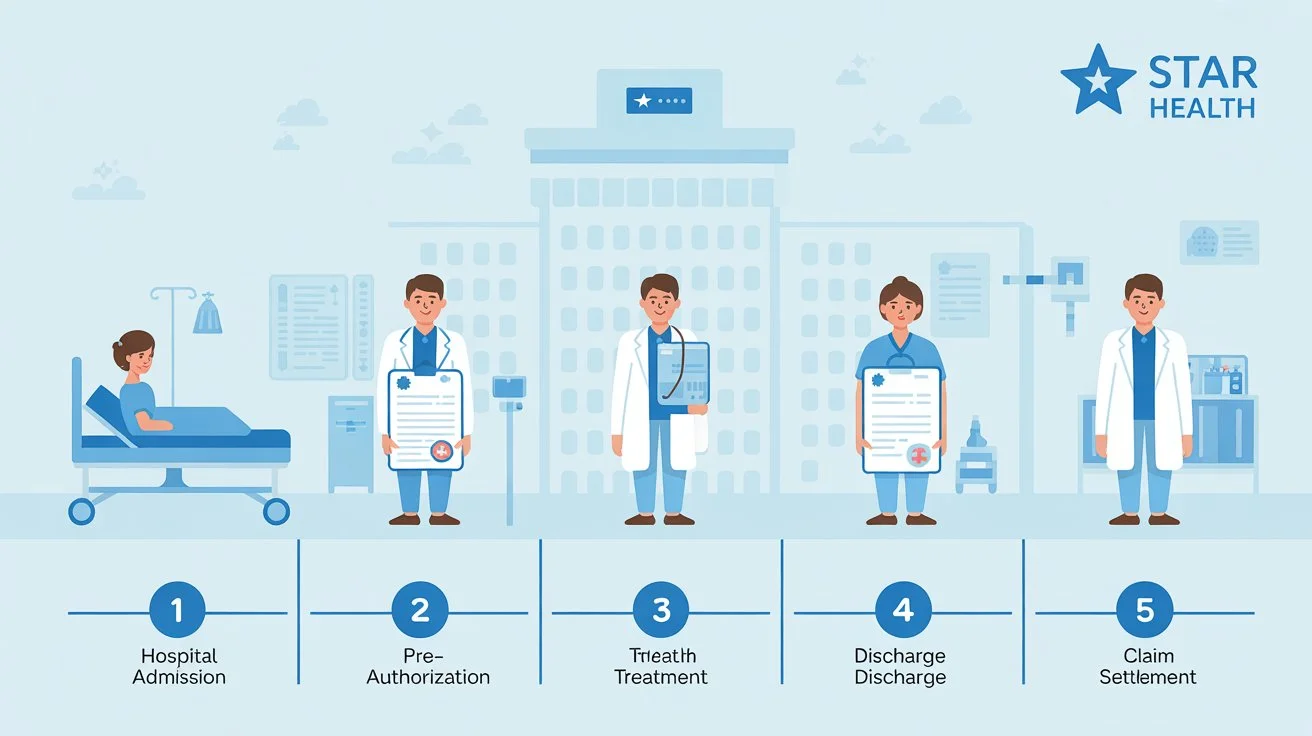

7. Claim Settlement Process (Step-by-Step)

Star Health has simplified the claim process for both cashless and reimbursement claims.

Cashless Claim Process:

Get admitted to a network hospital.

Inform the insurance desk and provide your Star Health card.

Hospital sends pre-authorization form to Star Health.

Once approved, your treatment begins without upfront payment.

After discharge, the hospital settles the bill directly with Star Health.

Reimbursement Claim Process:

Get treated in any hospital (network or non-network).

Pay the bills yourself.

Submit claim form with documents within 15 days.

Star Health verifies and reimburses the amount directly to your bank account.

On average, cashless claims are approved within 2–4 hours — one of the fastest in India.

Tax Benefits of Star Health Insurance

Under Section 80D of the Income Tax Act, you can claim:

Up to ₹25,000 deduction for self, spouse, and children.

An additional ₹50,000 deduction for parents (if they’re senior citizens).

So, apart from health protection, Star Health policies also provide financial savings.

Customer Reviews and Reputation

Star Health enjoys an excellent reputation for customer satisfaction and quick service.

According to IRDAI (Insurance Regulatory and Development Authority of India):

Claim Settlement Ratio (CSR): 93%

Customer Retention Rate: Above 90%

Average Claim Settlement Time: 2–4 days

Most policyholders praise Star Health’s approachable staff, minimal paperwork, and helpful claim desk during hospitalization.

Lessons from Real Experiences

Over years of helping families across India, some key lessons emerge:

Always disclose pre-existing diseases honestly.

Many claim rejections happen because people hide medical history.

Review hospital network before purchase.

Make sure nearby hospitals are covered for cashless treatment.

Opt for higher sum insured if living in metro cities.

Medical inflation is real — ₹10 lakh today may not be enough in 5 years.

Renew policies on time.

Missing renewal can lead to lapse of benefits and waiting periods restarting.

Tips for Choosing the Right Star Health Plan

If you’re young and single, go for Star Health Gain Policy.

For families, choose Family Health Optima.

For senior citizens, Red Carpet Policy is unmatched.

If you need comprehensive coverage, choose Star Comprehensive Plan.

Always compare premiums, sum insured, and waiting periods before deciding.

The Digital Advantage: Star Health App

The Star Health App makes everything seamless:

Policy renewal in seconds

Track claims in real time

Download e-cards

Find nearby network hospitals

Book teleconsultations with doctors

It’s a complete digital health companion that simplifies your insurance journey.

How Star Health is Supporting India’s Future Healthcare

Star Health is not just selling policies; it’s also contributing to India’s healthcare development by:

Partnering with hospitals to improve transparency

Introducing telemedicine services for rural areas

Promoting preventive healthcare awareness campaigns

Expanding coverage for critical and lifestyle diseases

The company’s focus is shifting from “insurance” to “assurance” — ensuring people live healthier, longer, and financially protected lives.

Common FAQs Star Health Insurance 2025

Q1. What is the claim settlement ratio of Star Health Insurance?

A: Around 93% according to IRDAI reports, which is among the best in the industry.

Q2. Can I buy Star Health policy online?

A: Yes, you can purchase and renew policies directly from their official website or app.

Q3. Does Star Health cover COVID-19?

A: Yes, Star Health has dedicated COVID-19 coverage plans and includes it under regular health policies as well.

Q4. What is the waiting period for pre-existing diseases?

A: Typically ranges between 12–48 months depending on the plan.

Q5. How can I check if a hospital is in the Star Health network?

A: Use the Star Health app or visit their website to find nearby network hospitals.

My Opinion: Why I Trust Star Health Insurance

After researching multiple insurers and hearing countless customer experiences, Star Health Insurance stands out for its human approach.

Unlike companies that hide behind processes, Star Health ensures that during emergencies, customers deal with people who care, not machines or endless forms. Their in-house claim system is a huge advantage that saves time and stress.

In a country like India, where healthcare costs are unpredictable and often unaffordable, Star Health acts like a safety net that gives peace of mind.

If you’re serious about protecting your family’s future health, Star Health Insurance is one of the most reliable and value-driven choices you can make today.

Final Thoughts

Health insurance is not just a policy — it’s a promise.

And Star Health has been keeping that promise for nearly two decades, helping millions of Indians face medical emergencies with confidence and dignity.

Choosing Star Health means choosing trust, transparency, and timely support — values that truly define a dependable health partner.