Small Business Loan Interest Rate in 2025: What Entrepreneurs Should Know

Starting or running a small business often requires external funding, and one of the most common sources is a small business loan. While the availability of credit has expanded in recent years, the real game-changer for entrepreneurs in 2025 is the interest rate landscape.

Having written about finance and small businesses for over a decade, I’ve noticed how loan rates directly shape entrepreneurial decisions—whether it’s opening a new café, expanding a small textile unit, or upgrading machinery. Let’s dive deep into how interest rates on small business loans are shaping up in 2025, what factors influence them, and what business owners should consider before borrowing.

Current Small Business Loan Interest Rates in 2025

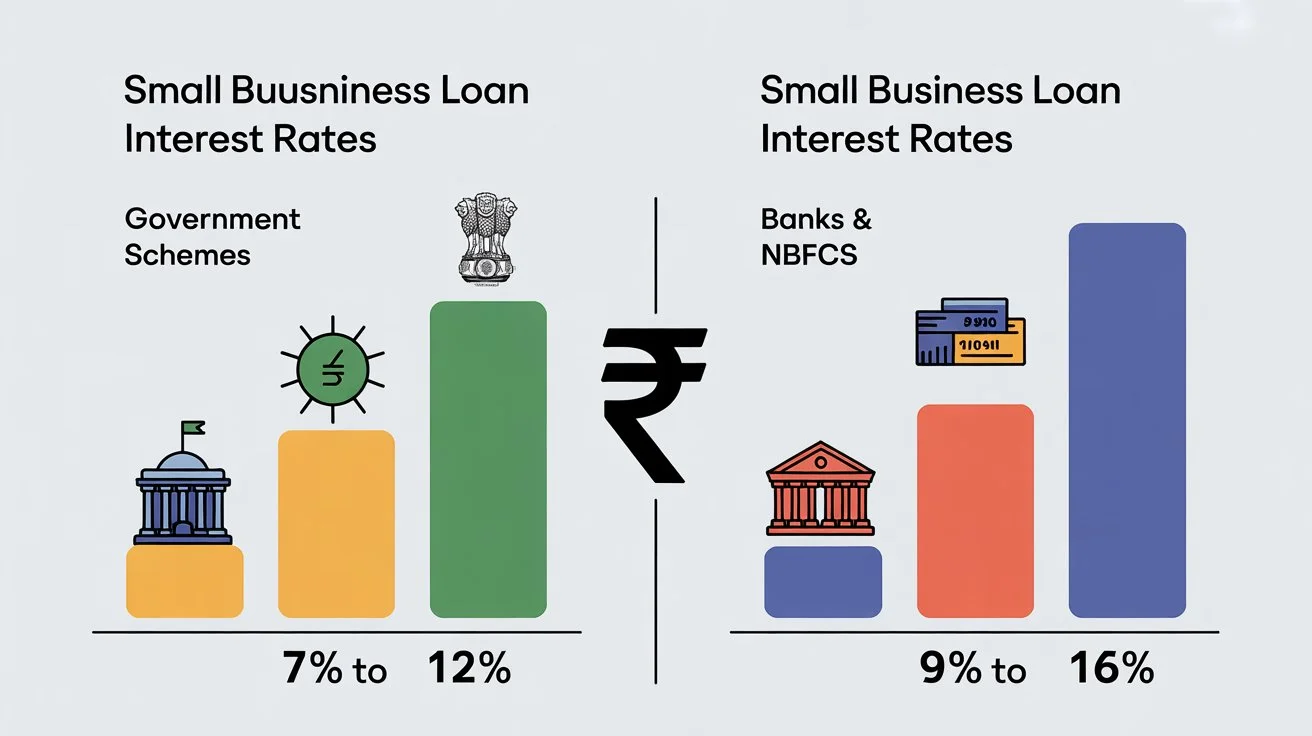

The small business loan interest rate in 2025 varies depending on the lender, borrower profile, and loan type. Broadly:

Banks & NBFCs: 9% – 16% per annum

Government-Backed Schemes (like Mudra, CGTMSE, Stand-Up India): 7% – 12% per annum

Digital Lending Platforms & Fintechs: 12% – 24% per annum (higher due to quick approvals and flexible eligibility)

Microfinance Institutions (for very small enterprises): 14% – 26% per annum

Compared to 2020–2022, when post-pandemic stimulus kept rates lower, 2025 has seen a slight upward trend due to inflation control measures and tighter global liquidity.

Factors Influencing Interest Rates in 2025

Interest rates are never static. They depend on several elements, many of which small business owners often overlook:

1. Economic Conditions

The RBI repo rate in 2025 has been relatively stable but slightly elevated compared to the pre-pandemic years. When the repo rate rises, banks pass on the cost, leading to higher loan EMIs for businesses.

2. Business Creditworthiness

A small garment shop owner I interviewed in Jaipur shared that his loan request was approved at 10.5% simply because his repayment history was spotless. Meanwhile, another entrepreneur in the same area faced a 16% rate due to poor credit. This shows how credit score and repayment record can make or break your loan terms.

3. Loan Type & Collateral

Secured Loans (with collateral like property or machinery) generally attract lower rates (8%–12%).

Unsecured Loans come at a premium (12%–22%) because of higher risk to the lender.

4. Lender Type

Banks still offer the most competitive rates, but their documentation process can be tedious. Fintechs and NBFCs provide faster disbursals but charge more for convenience.

Real-World Example: How Loan Rates Impact Business

In 2024, I met a small bakery owner in Pune who took a ₹10 lakh loan at 11% to buy new ovens and expand seating. Her monthly EMI was around ₹21,800, which fit well within her cash flow.

By contrast, another food truck entrepreneur opted for a fintech loan at 18% interest for the same amount, simply because he wanted instant approval. His EMI jumped to nearly ₹25,800—₹4,000 more every month. That extra outflow, over a five-year term, cost him more than ₹2.4 lakh extra in interest.

This highlights why comparing loan options and rates is not just smart but absolutely necessary.

Tips to Secure the Best Interest Rate in 2025

1. Maintain a Strong Credit Score

A score above 700+ gives you leverage with lenders. Always pay EMIs, GST dues, and vendor payments on time.

2. Explore Government Schemes First

Programs like PMMY (Mudra Yojana), Stand-Up India, and SIDBI loans still offer subsidized rates in 2025. For women entrepreneurs and rural businesses, rates can be 1–2% lower.

3. Compare Multiple Lenders

Never settle for the first offer. Use loan aggregator websites or consult with a financial advisor before signing.

4. Negotiate if Possible

If you have a solid repayment track record, don’t hesitate to negotiate. One of my acquaintances running a printing press in Delhi successfully reduced his rate from 13% to 11.8% just by asking his bank manager to reconsider based on his past repayment discipline.

5. Choose Loan Tenure Wisely

Longer tenures reduce EMIs but increase total interest paid. Shorter tenures can save lakhs in the long run.

Predicted Trend: What’s Next for 2025 and Beyond?

Most experts believe that interest rates in 2025 will remain moderate but not cheap. With inflationary pressures and global market uncertainties, the RBI is unlikely to slash rates drastically.

Short-term outlook: Stable to slightly high interest rates (9–14% range).

Medium-term outlook (2026–2027): Possible easing if inflation cools and global growth stabilizes.

For small businesses, this means prudent financial planning and avoiding unnecessary debt will be more crucial than ever.

My Opinion

Having observed entrepreneurs over the years, my personal takeaway is simple:

Don’t chase “fast loans” just because they’re convenient. The interest burden can quietly erode your profits.

Instead, build a strong credit history, prepare documentation, and patiently negotiate.

A well-chosen loan can fuel growth, while a poorly chosen one can become a financial trap.

In 2025, the smart small business owner is not the one who gets a loan the fastest, but the one who secures it at the right interest rate.

Final Thought:

Small business loan interest rates in 2025 are a balancing act between accessibility and affordability. Entrepreneurs who do their homework—checking schemes, comparing lenders, and maintaining credit discipline—will come out ahead.

5 FAQs on Small Business Loan Interest Rate in 2025

1. What is the average small business loan interest rate in India in 2025?

In 2025, small business loan interest rates in India typically range between 9% and 16% for banks and NBFCs, while government-backed schemes can start as low as 7% per annum.

2. Which bank offers the lowest business loan interest rate in 2025?

Banks like SBI, HDFC, and ICICI are among the top lenders offering competitive rates, often starting around 9%–11% depending on creditworthiness and collateral.

3. Are government schemes cheaper than private loans?

Yes. Schemes like PM Mudra Yojana, Stand-Up India, and SIDBI loans usually come with subsidized interest rates, sometimes 2–3% lower than regular bank loans.

4. Can I get a business loan in 2025 without collateral?

Yes, unsecured business loans are available from banks, NBFCs, and fintechs. However, the interest rate is usually higher—between 12% and 24%—due to higher risk.

5. How can I reduce my business loan interest rate in 2025?

You can lower your interest rate by maintaining a 700+ credit score, providing collateral, applying under government-backed schemes, and comparing multiple lenders before choosing.